11 Individual Self-assessment tax system The SAS is the abbreviation of self-assessment tax system which has been levied upon personal taxpayers by the Malaysian Inland Revenue Board MIRB to encourage tax compliance Yeo13. However where IRD amends a taxpayers assessment as part of the auditing process the taxpayer can object it or make an appeal.

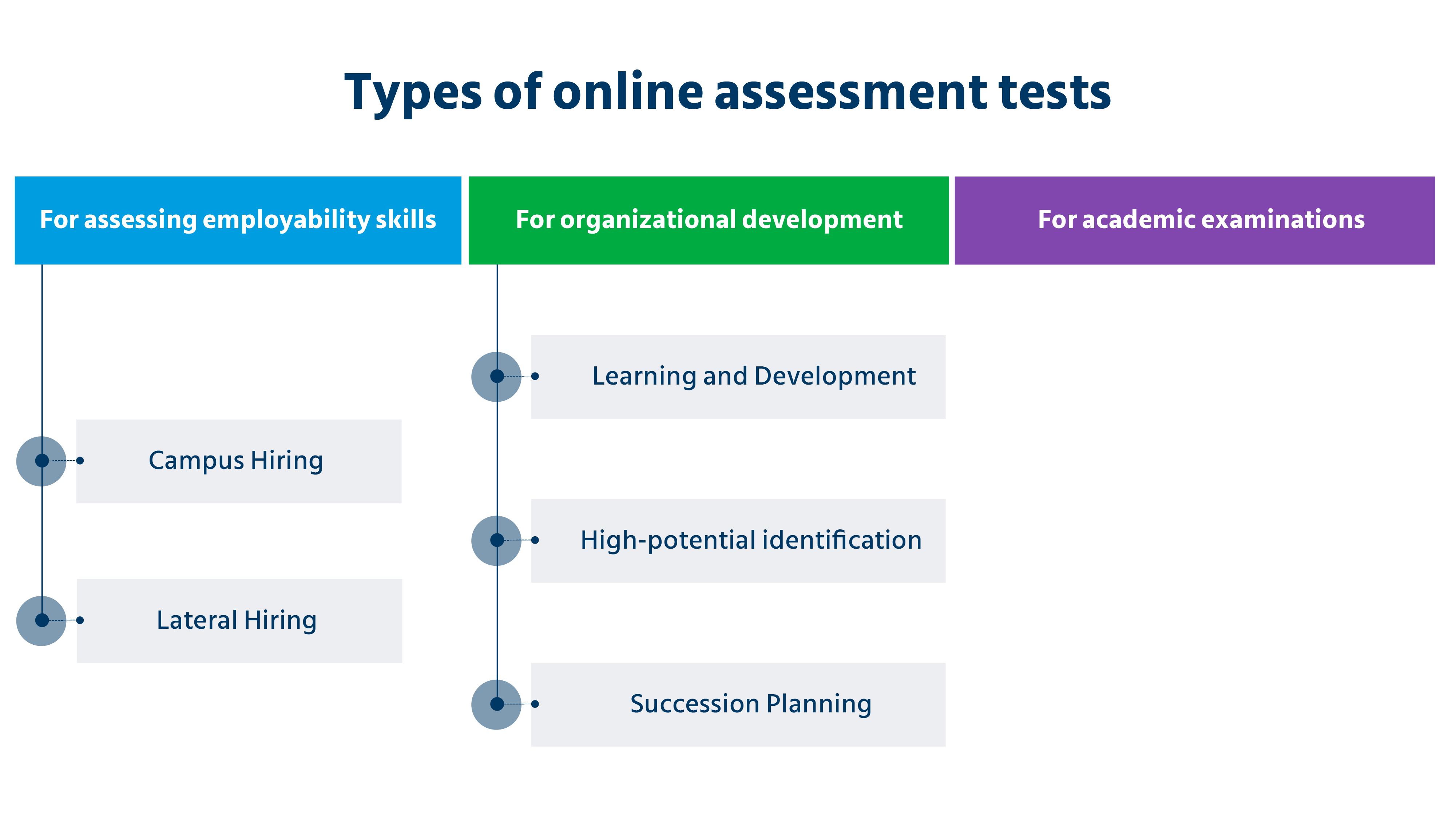

What Is An Online Assessment Here S Everything You Need To Know

Under the self-assessment system a tax return furnished to the IRB is an assessment deemed to be made by the IRB.

. Malaysia has adopted an Official Assessment System OAS whereby taxpayers were assessed by the tax authorities based on the tax returns filled by them. Mohd R Palil Tax knowledge and tax compliance determinants in self assessment system in Malaysia Doctoral dissertation Retrieved from Electronic Theses Online Service. Individual and spouse elect for separate assessment.

Noor Sharoja Sapiei Faculty ofBusiness andAccountancy University ofMalaya Malaysia. Introduction On 1 January 2005 in order to promote voluntary tax compliance the Inland Revenue Board Malaysia the IRBM has implemented the self-assessment tax system the SAS on individual taxpayers Chong Wong 2011Under the SASindividual who has income accruing in or derived from Malaysia are required to disclose taxable incomehonestly compute. We have noticed an unusual activity from your IP 407716770 and blocked access to this website.

Introduction At the time of the Malaysian governments Look East policy in the 1980s1 there were calls for the introduction of a self-assessment SA system of taxation modelled on that of Japan2 These calls were aimed at enabling the Malaysian Inland Revenue Department3 to deploy its staff to more productive functions. The amount of tax payable for the year must be self-computed and the tax return is deemed to be a notice of assessment. Professor JeyapaJan Kasipillai School ofBusiness Monash University Malaysia Abstract.

Malaysias taxes are assessed on a current year basis and are under the self-assessment. The Self-assessment System Dr. 307 the effects of the self-assessment system on the tax compliance costs of SMALL AND MEDIUM ENTERPRISES IN MALAYSIA It is important to note that the current study was restricted to companies only.

The Malaysian Government has introduced a Self Assessment System SAS in stages commencing with companies from 2001. The system has been effectively implemented effective from 2004 onwards. Below are types of individual assessment.

Thaxpayers are expected to perform the primary tasks that were previously handled by the tax authority which emphasizes on completing tax returns accurately including computing. The aggregation of total income can. Individual is Single Widow Widower Divorcee Spouse with no source of Income.

Revenue Board Malaysia the IRBM has implemented the self-assessment tax system the SAS on individual taxpayers in order to promote voluntary tax compliance. This new strategy require taxpayers to take more responsibility for getting their tax returns. For additional information please contact the Internal Revenue Department at one.

Prior to 2001 Malaysia adopted an official assessment system whereby tax payers are assessed to income tax by the IRB based on the tax return filed by them. SELF-ASSESSMENT SYSTEM Malaysia has all the. 1st International Conference on Public Policy and Social Science 2010 ICoPS 2010 At.

Self-assessment for individuals. The amount of tax payable for the year must be self-computed and the tax return is deemed to be a notice of assessment upon its submission. Under the SAS individual who has income accruing in or derived from Malaysia are required to disclose taxable income honestly compute tax payable correctly file tax return form and pay tax on a.

Under Self-Assessment System the taxpayer cannot object or make an appeal on the amount which they self-assessed. SELF ASSESSMENT SYSTEMSAS In the 1999 budget it was announced that the official assessment system under which taxpayer were assessed to income tax under the Income Tax Act 1967 by the IRB based on the tax returns filed by them was to be relpaced by. And to encourage taxpayers to have a better.

Malaysia adopts the self-assessment system where the taxpayer is responsible for computing ones own chargeable income and tax payable as well as making payments of any balance of tax due. The adoption of Self-Assessment System SAS results in a considerable shift of responsibility upon taxpayers with regards to their compliance obligations. As indicated by the SAS who has aggregated income or acquired.

The husband wife who elects for joint assessment must be a Malaysian citizen if not resident in Malaysia. Malaysia adopts the self-assessment system where the taxpayer is responsible for computing ones own chargeable income and tax payable as well as making payments of any balance of tax due. This study seeks to explore and identify the key dimensions that determine the service quality of the Inland Revenue Board Malaysia IRBM under the new Self-Assessment tax system.

Reforms and changes in tax laws may affect the level of complexity in the tax system and increase taxpayer compliance costs burden. SP Inn Hotel Kedah Malaysia. Ad See the Self Assessment Tools your competitors are already using - Start Now.

Self Assessment SystemSas in Malaysia. Read reviews on the premier Self Assessment Tools in the industry. The self-assessment system is essentially a process by which taxpayers are required by law to determine the taxable income compute the tax liability and submit their tax.

Malaysia applies the self-assessment system SAS in its tax administration.

Digital Postural Analysis App Software Accurate And Reliable Posture Assessment Evaluation And Analysis On Ipad Ip Workout Plan Template Assessment Analysis

Payroll Software Malaysia Realize Your Best Performers For Appraisals And Promotions And Move Your Company In The Right Directio Payroll Software Payroll Hrms

And When You Don T Eat Nearly Enough Of All Your Vegetables Fruits Idlife Will Individually Design The Right Dosage Of Vitamins S Health Food Healthy Health

Ta05346 Finance Islam How To Plan

What Is Marketing Automation How Does It Work Marketing Automation What Is Marketing Self Assessment

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

This Infographic Takes A Look At Both The Informal Reading Inventory And The Benchmark Assessment System I Reading Inventory Literacy Assessment Teacher Help

Link In Bio Download What Do U Think About This Share With Us Comment Below Follow Myelitemastermind Follow

General Information Our Next Sia Level 3 Close Protection Officer Course Close Protection Training Academy Protection

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Fundamental Analysis Software A Complete Guide 2020 Edition Ebook By Gerardus Blokdyk Rakuten Kobo Fundamental Analysis Safety Management System Security Architecture

Apply For Permission Apply And Cancel Leave Leave Reimbursement Claims Advance Overtime Apply Travel User Relief E Payroll Software Self Service Payroll

Basic Questions On The Growth And Development Of Economics Free Udemy Coupon Code Economics Free Online Learning Udemy

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

Control Self Assessment Deloitte Australia Our Services And Solutions Risk Solutions Risk Management Assessment Reporting

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Iri V Benchmark Literacy Assessment Literacy Assessment Benchmark Literacy Reading Inventory